In the world of international trade and customs classification, having the right Harmonized System (HS) code is crucial. The HS code, a standardized numerical method of classifying traded products, is used by customs authorities around the globe to identify goods, assess duties and taxes, and track trade statistics. For businesses engaged in the import and export of specialized products, accurately determining the appropriate HS code can mean the difference between smooth customs clearance and costly delays.

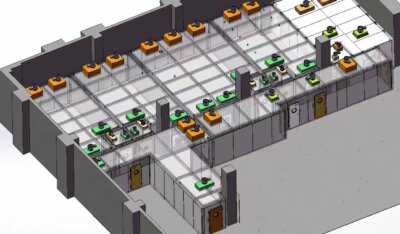

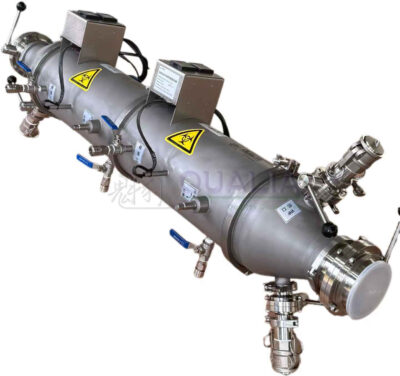

One such specialized product category is “bag in bag out” (BIBO) systems. BIBO refers to a type of filtration or containment technology commonly used in industries such as pharmaceutical manufacturing, semiconductor fabrication, and nuclear power plants. These systems feature an inner bag that can be removed and replaced, often without disrupting the outer containment bag, allowing for safe and efficient material handling and waste disposal.

what is the HS code for “bag in bag out” products?

The appropriate HS code for BIBO systems and related items is 3923.29.0000, which falls under the broader category of “Plastics and articles thereof; other articles.”

To understand the significance of this HS code, let’s delve deeper into the structure and classification of the Harmonized System:

The Harmonized System is organized into 21 Sections, which are further divided into 99 Chapters. Each Chapter is then subdivided into four-digit HS Headings and six-digit HS Subheadings. The ten-digit codes used for U.S. customs purposes, known as Schedule B or HTS (Harmonized Tariff Schedule) codes, are derived from these six-digit international HS Subheadings.

In the case of BIBO products, the relevant HS Heading is 39.23, which covers “Articles for the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics.” The specific Subheading is 3923.29, which is described as “Sacks and bags (including cones), of plastics, other than those of 3923.10.”

The ten-digit HS code 3923.29.0000 further refines this classification, encompassing a wide range of plastic sacks, bags, and similar containers that do not fall under the more specific Subheadings, such as 3923.21 (Sacks and bags (including cones), of polymers of ethylene) or 3923.29.1000 (Shipping sacks and bags, of polymers of ethylene).

By classifying BIBO products under HS code 3923.29.0000, customs authorities can differentiate them from other plastic packaging items and apply the appropriate tariff rates, duties, and trade regulations. This code also allows for the tracking of global trade data related to these specialized containment systems.

It’s important to note that the specific HS code assignment may vary slightly across different countries and regions, as national customs authorities have the authority to create their own ten-digit codes based on the international six-digit HS Subheadings. However, the core six-digit code of 3923.29 would remain consistent globally.

- Bag in Bag out

- Mechanical Seal APR Doors

- What is the process of bag in bag out?

- Ensuring Safety with Bag-in/Bag-out: The Definitive Guide to Hazardous Filter Replacement

- Inspection & Testing of Commissioning Services

For businesses engaged in the import or export of BIBO systems and related products, accurately identifying the correct HS code is crucial for several reasons:

Customs Clearance: The HS code determines the applicable import/export duties, taxes, and any trade restrictions or quotas that may apply to the shipment. Using the wrong code can lead to delays, additional fees, or even the rejection of the shipment at the border.

Tariff Calculations: The HS code is used to determine the correct tariff rate, which can significantly impact the overall cost of the imported or exported goods.

Trade Data Tracking: Accurate HS code usage allows for the precise tracking of trade flows and volumes for specific product categories, which is valuable for market analysis, policy decisions, and industry trend monitoring.

Regulatory Compliance: Certain products may be subject to specific regulations or licensing requirements based on their HS classification. Correctly identifying the code ensures compliance with applicable laws and avoids potential penalties.

In conclusion, the HS code 3923.29.0000 is the appropriate classification for “bag in bag out” products and related plastic containment systems. By understanding the significance of this code and its place within the broader Harmonized System, businesses can navigate the complexities of international trade with confidence, ensuring smooth customs clearance and compliance with relevant regulations.

Related Contents:

- Enhancing Facility Safety with Bag In Bag Out (BIBO) Systems: A Comprehensive Overview

- How Bag-in Bag-out Systems Enhance Lab Safety

- Innovative Containment Solutions: Bag-in Bag-out Systems Explained

- Bag In Bag Out Filters: The Ultimate Guide to Safe and Efficient Filter Replacement

- Top Benefits of Using Bag-in Bag-out Systems for Contamination Control

- How Bag In Bag Out (BIBO) Systems Ensure Safety in Contaminant Removal

- Ensuring Safety with Bag-in/Bag-out: The Definitive Guide to Hazardous Filter Replacement

- Key Features of Qualia’s Bag-in Bag-out Filtration Systems

- Applications of Bag-in Bag-out Systems in Pharmaceutical Labs