For medical device manufacturers, the choice between in-house and outsourced vaporized hydrogen peroxide sterilization is a critical inflection point. It’s a decision that balances capital investment against operational flexibility, strategic control against supply chain dependency. Misconceptions abound, often centering on a simple cost-per-load comparison while overlooking the profound implications for product development speed, regulatory strategy, and long-term resilience.

This analysis is urgent. Regulatory pressure is accelerating the industry’s migration from ethylene oxide, creating capacity constraints. Concurrently, the FDA’s recognition of VHP as an Established Category A method reduces submission risk. Companies must now model this decision not as a mere operational cost center, but as a strategic capability that can define competitive agility and market responsiveness.

In-House vs Contract VHP Sterilization: Core Differences

Defining the Operational Models

The fundamental divergence is between ownership and partnership. In-house VHP sterilization represents a vertical integration of a critical manufacturing step. It requires significant capital expenditure for equipment, facility modifications, and the development of specialized internal expertise. This model internalizes control over scheduling, cycle development, and priority handling. Conversely, contract sterilization converts a capital expense into a variable operational cost. It leverages a provider’s existing infrastructure, multi-client throughput, and accumulated process knowledge, trading direct control for scalability and reduced upfront financial risk.

The Strategic Trade-Off: Autonomy vs. Agility

The core trade-off is strategic. In-house autonomy enhances supply chain resilience by eliminating dependency on external queues and cross-country shipping, a critical buffer against industry-wide capacity crunches. It allows for rapid iteration on cycle parameters for sensitive new devices. However, this control demands commitment. Contract services offer operational agility, enabling a company to scale sterilization volume up or down without fixed asset risk and to access a broader range of chamber sizes or complementary technologies like radiation. The provider manages the staffing, maintenance, and core validation burdens.

Impact on Product Lifecycle Velocity

This choice directly impacts speed-to-market. An in-house facility can accelerate lot release for clinical trials or commercial launch by removing transit and queue times. Our experience shows that for fast-track development programs, this internal control can shave weeks off critical timelines. However, it requires the company to build and maintain deep cycle development expertise in-house to tackle challenges like preventing condensation in complex, long-lumen devices—a non-trivial technical hurdle.

Total Cost of Ownership: Capital vs. Operational Expense

Unpacking the True Cost Components

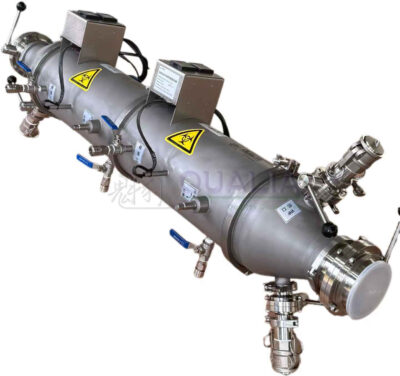

A rigorous financial analysis must look beyond the sterilization chamber’s price tag. In-house Total Cost of Ownership (TCO) is a blend of substantial capital expenditure (CapEx) and ongoing operational costs (OpEx). CapEx includes the VHP generator, vacuum chamber, and often extensive facility modifications for proper ventilation and classification. OpEx encompasses salaries for skilled technicians and QC microbiologists, preventive maintenance contracts, consumables like hydrogen peroxide solution, and the recurring cost of revalidation. Contract sterilization appears simpler, primarily involving per-load fees, but must also include line items for validation services, dedicated sterile barrier packaging, and round-trip logistics.

Modeling the Financial Break-Even

The break-even point is fundamentally volume-driven. High, consistent annual throughput amortizes the high fixed capital cost of an in-house setup, leading to a lower cost per unit over time. For lower or unpredictable volumes, the pure variable cost model of outsourcing remains financially prudent. A robust analysis uses Net Present Value (NPV) over a 5-10 year horizon, not just a simple payback period. It must also model the often-overlooked value of eliminated shipping delays and the internal resource cost of developing cycle development expertise.

A Comparative Cost Framework

The following table outlines the primary cost drivers for each model, providing a framework for initial TCO estimation.

Total Cost of Ownership: Capital vs. Operational Expense

| Cost Component | In-House (CapEx/OpEx) | Contract Service (OpEx) |

|---|---|---|

| Primary Equipment | VHP generator & chamber | Per-load processing fee |

| Facility & Build-out | Significant modification costs | Provider infrastructure |

| Key Personnel | Skilled technicians & QC staff | Supplier management team |

| Ongoing Costs | Maintenance, consumables, validation | Validation, packaging, logistics |

| Financial Model | High fixed, lower variable cost | Pure variable operational cost |

Source: ISO 13485:2016 Medical devices — Quality management systems — Requirements for regulatory purposes. This standard governs the financial and operational aspects of both models, requiring documented control of supplier management (for contract services) and validation/maintenance of equipment (for in-house), which are core cost drivers in the TCO analysis.

Note: The break-even point is determined by annual sterilization volume, with high, consistent throughput favoring in-house investment.

Which Offers Better Control & Supply Chain Resilience?

The In-House Advantage for Control

In-house sterilization provides unparalleled control and resilience. It eliminates dependency on external service queues, third-party transportation networks, and the potential for cross-contamination from multi-user facilities. This control enables faster lot release, just-in-time manufacturing responses, and direct oversight of every parameter change. It acts as a strategic buffer, securing dedicated capacity when industry-wide constraints arise from the phasedown of EtO. Companies that implement in-house VHP gain a tangible competitive advantage in agility.

Mitigating Risk in an Outsourced Model

Contract services introduce logistical dependencies but can mitigate risk through strategic partnership. A strong provider alliance offers integrated solutions, guaranteed capacity slots, and access to multi-technology portfolios (e.g., VHP, E-beam, X-ray). This can be advantageous for companies with a diverse product mix. However, it requires a robust Supplier Quality Management (SQM) system, defined in ISO 13485:2016, including regular audits and clear quality agreements. The resilience here is in the partner’s redundancy and expertise, not in direct schedule control.

The Hidden Cost of Lost Control

The cost of lost control is often realized during demand surges or product launch delays. When relying on a contract sterilizer, your priority competes with other clients’. An internal capability allows you to reprioritize instantly. This control extends to intellectual property; sensitive device designs and optimized cycle parameters remain within your walls. For companies where sterilization is a core differentiator for product performance, this control is not just an operational preference—it’s a strategic necessity.

Technical Performance & Capacity: A Direct Comparison

Fundamental Process Parity

Technically, both models utilize the same sterilization agent: low-temperature vaporized hydrogen peroxide that oxidizes microbial life, leaving only water and oxygen as residuals. The performance criteria defined in ISO 22441:2022 for cycle development, validation, and routine control apply equally. The difference lies not in the basic efficacy but in the application and optimization of the process.

Optimization and Access Divergence

In-house operations allow for dedicated, device-optimized cycle development. Teams can invest time in refining cycles for a specific product portfolio, potentially achieving faster cycle times or enhancing material compatibility margins. Contract facilities offer breadth of experience, having validated cycles for thousands of different load configurations across many clients. They provide access to a range of chamber sizes, which is crucial for prototyping versus full-scale production.

The Universal Constraint of Material Compatibility

A critical technical constraint is identical for both models: VHP’s material incompatibility with cellulosics like paper, cardboard, and certain adhesives. This forces a fundamental shift to polymer-based sterile barrier systems (e.g., Tyvek® pouches) and excludes the high-volume palletized sterilization common with EtO. This redefines packaging workflows and is a primary throughput limiter.

The table below compares key technical and operational parameters between the two models.

Technical Performance & Capacity: A Direct Comparison

| Parameter | In-House VHP | Contract VHP |

|---|---|---|

| Cycle Development | Dedicated, device-optimized cycles | Broad, multi-product experience |

| Chamber Access | Single, dedicated size | Range of available sizes |

| Key Constraint | Material incompatibility (cellulosics) | Material incompatibility (cellulosics) |

| Throughput Driver | Internal scheduling & priority | External queue & logistics |

| Packaging Workflow | Must use VHP-compatible polymers | Must use VHP-compatible polymers |

Source: ISO 22441:2022 Sterilization of health care products — Low temperature vaporized hydrogen peroxide. This standard defines the technical requirements for VHP sterilization processes, including material compatibility limits and cycle development/validation protocols, which are fundamental performance factors for both operational models.

Key Operational Factors: Staffing, Space & Maintenance

Facility and Human Resource Requirements

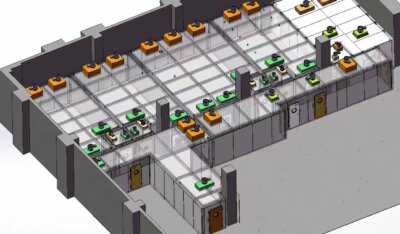

Operationalizing an in-house VHP station demands dedicated resources. The facility requires a controlled environment, typically at least ISO Class 8 (Class 100,000), with appropriate utility hookups, ventilation, and often a separate loading vestibule. Staffing is a significant, ongoing OpEx: you need trained sterilization technicians, QC personnel for biological indicator reading and environmental monitoring, and access to maintenance engineers. Contract services offload this entire operational burden, but your team must shift focus to rigorous supplier quality management.

The Critical Expertise of Cycle Development

The most significant operational hurdle is cycle development expertise. Managing vapor concentration, injection rate, and pressure to achieve sterilization without causing condensation within complex devices—like those with long, narrow lumens or absorbent materials—requires deep, practical experience. Building this competency internally takes time and carries risk. A contract sterilizer provides this expertise as a service, but you relinquish direct control over the development timeline and granular parameter decisions.

Maintenance and Uptime Assurance

For in-house operations, uptime depends on a proactive maintenance program and a spare parts inventory. Downtime directly halts production. The guidelines in ANSI/AAMI ST58:2013 provide a framework for the safe and effective operation and maintenance of chemical sterilization equipment within a facility. With a contract service, maintenance is the provider’s responsibility, but your production is still vulnerable to their equipment failures.

The operational demands of each model are compared below.

Key Operational Factors: Staffing, Space & Maintenance

| Operational Factor | In-House Requirement | Contract Service Requirement |

|---|---|---|

| Facility Classification | ISO Class 8 or better | Provider-managed facility |

| Core Staffing | Sterilization techs, QC, engineers | Supplier Quality Management (SQM) |

| Critical Expertise | Internal cycle development | Partner-provided expertise |

| Maintenance Burden | Full preventive & spare parts | Provider responsibility |

| Technical Challenge | Condensation in complex devices | Managed via partner protocol |

Source: ANSI/AAMI ST58:2013 Chemical sterilization and high-level disinfection in health care facilities. This guideline provides practical requirements for the safe and effective operation of VHP equipment within a facility, directly informing the staffing, space, and maintenance needs for an in-house installation.

The Role of Validation & Regulatory Compliance

Ownership of the Validation Lifecycle

In-house sterilization requires full ownership of the validation lifecycle: Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ), followed by ongoing annual revalidation and meticulous change control documentation. This offers direct control over the regulatory strategy and content of the Device Master File. It allows for rapid updates to cycles as products evolve. Companies must adhere to the general principles for process characterization and validation outlined in ISO 14937:2009.

Leveraging Provider Master Files

Outsourcing leverages the contract sterilizer’s established validation protocols and often their 510(k) master file for the specific equipment model. This reduces the sponsor’s direct burden for the equipment IQ/OQ. However, device-specific cycle validations (PQ) are still required and are typically managed as a fee-for-service project. The sponsor remains ultimately responsible for the validation data submitted to regulators but relies on the partner’s expertise and documentation systems.

Navigating the Regulatory Landscape

The regulatory environment now favors VHP adoption. Its FDA classification as an Established Category A method streamlines submissions compared to novel processes. This de-risks the regulatory path for both operational models. However, the EPA’s ongoing actions to reduce EtO emissions are driving a capacity migration, making the timing of implementing a controlled, alternative modality like VHP a strategic compliance decision, not just a technical one.

Decision Framework: Volume, Product Mix & Strategy

Quantitative Volume Analysis

The primary quantitative driver is annual sterilization volume. A detailed, multi-year forecast is essential. High, predictable volume (>~500-1000 cycles/year, depending on chamber size and load value) typically justifies in-house investment. Low, sporadic, or highly uncertain volume strongly favors the variable cost model of outsourcing. The analysis must model best-case, worst-case, and expected scenarios to understand the financial risk profile.

Qualitative Strategic Assessment

Beyond volume, the product mix and corporate strategy are decisive. A portfolio dominated by complex, sensitive devices that may require frequent cycle adjustments benefits from dedicated in-house focus. A diverse mix of products might be better served by a contract partner with multi-modal capabilities. Strategically, leadership must decide if controlling this terminal process is a core competency that warrants capital for speed, IP protection, and supply chain sovereignty.

Integrating Factors into a Choice Matrix

Leading manufacturers are moving toward a strategic sterilization portfolio, matching the optimal modality (VHP, EtO, radiation) to specific device requirements rather than a one-size-fits-all approach. This perspective can make a contract partner with a full technology suite more attractive, or it may justify in-house VHP for a specific high-volume product line while outsourcing others.

The following framework summarizes how key decision drivers lean toward one model or the other.

Decision Framework: Volume, Product Mix & Strategy

| Decision Driver | Favors In-House | Favors Contract Service |

|---|---|---|

| Annual Volume | High & predictable | Low or fluctuating |

| Product Complexity | Sensitive, frequent tweaks needed | Diverse, standard cycles suitable |

| Strategic Goal | Control, speed, IP protection | Flexibility, scalability |

| Core Competency | Sterilization as strategic asset | Focus on core manufacturing |

| Regulatory Timeline | Manage own validation strategy | Leverage provider master file |

Source: ISO 14937:2009 Sterilization of health care products — General requirements for characterization of a sterilizing agent. This foundational standard outlines the principles for process development and validation, which are key strategic considerations when deciding whether to build this capability internally or partner with an external expert.

Next Steps: Conducting Your Break-Even Analysis

Building Your Cost Models

Begin by quantifying the total annual cost of outsourcing. Aggregate all per-load fees, validation service costs, dedicated VHP-compatible packaging expenses, and transportation logistics. Next, calculate the in-house TCO. Sum all CapEx for equipment like a type I hydrogen peroxide generator and facility modifications. Project annual OpEx over a 5-10 year horizon, including personnel, utilities, maintenance, and revalidation.

Performing the Financial Analysis

Calculate the simple payback period (Total CapEx / Annual Outsourcing Cost Savings). For a more robust view, perform a Net Present Value (NPV) analysis, discounting future cash flows. This will show the true long-term value of the investment. A positive NPV indicates the in-house investment creates value over the outsourcing alternative, given your volume and cost projections.

Making the Holistic Decision

Finally, integrate the qualitative factors. Assign strategic value to supply chain control and reduced time-to-market. Consider your regulatory migration timeline away from EtO. Evaluate the opportunity for packaging innovation with VHP-compatible materials. This holistic analysis frames the capital investment not as a mere expense, but as a strategic play for resilience, agility, and controlled growth in a shifting regulatory landscape.

The decision between in-house and contract VHP sterilization hinges on a nuanced analysis of volume, product strategy, and risk tolerance. High-volume, complex device manufacturers will find strategic value in the control and speed of an internal facility, amortizing the capital cost over time. Companies with fluctuating demand or a focus on core manufacturing competencies may benefit more from the flexibility and shared expertise of a qualified partner.

Need professional guidance to model your specific break-even analysis and explore VHP integration strategies? The experts at QUALIA provide technical and strategic consulting to help medical device companies navigate this critical decision, ensuring compliance, efficiency, and supply chain resilience.

For a detailed discussion of your specific requirements, you can also Contact Us.

Frequently Asked Questions

Q: What are the key ISO standards for validating a VHP sterilization process, whether in-house or outsourced?

A: The primary standard is ISO 22441:2022, which details specific requirements for developing, validating, and controlling low-temperature VHP processes. This is supported by the general framework in ISO 14937:2009 for characterizing sterilizing agents and establishing processes. This means any facility implementing VHP must design its validation protocol around these documents, regardless of the operational model chosen.

Q: How does the total cost of ownership for in-house VHP compare to contract service fees?

A: In-house TCO includes major capital expenses for equipment and facility modifications plus ongoing operational costs for validation, specialized staff, and maintenance. Outsourcing converts this into variable per-load fees, validation services, and logistics costs. The break-even point depends on your annual throughput; high, consistent volume justifies the capital investment, while lower or unpredictable volume favors the variable cost model of a contract partner.

Q: Which operational model provides better control over supply chain resilience for critical devices?

A: An in-house facility provides superior control by eliminating external service queues and shipping dependencies, enabling faster lot release and rapid response to demand changes. This creates a strategic buffer against industry capacity constraints. If your strategy prioritizes speed-to-market and securing a controlled capacity advantage, you should weigh this resilience against the capital commitment and operational complexity of an in-house setup.

Q: What are the main staffing and facility requirements for operating an in-house VHP unit?

A: You need dedicated space with at least an ISO Class 8 cleanroom classification, appropriate utilities, and ventilation. Staffing requires trained sterilization technicians, microbiology QC personnel, and maintenance engineers to manage cycle development and equipment uptime. This means companies must budget for these significant, ongoing resource costs and expertise development, which are fully managed by the provider in an outsourcing model.

Q: How does regulatory compliance responsibility differ between in-house and contract VHP sterilization?

A: With an in-house process, your quality system owns the entire validation lifecycle (IQ/OQ/PQ) and documentation for audits per ISO 13485:2016. Outsourcing leverages the contract sterilizer’s established equipment validation and master file, reducing your direct burden, though device-specific cycle validations remain your responsibility. This means in-house offers more direct control over regulatory strategy but demands greater internal quality management system rigor.

Q: What technical constraint of VHP most significantly impacts packaging and throughput capacity?

A: VHP is incompatible with cellulosic materials like paper and cardboard, which forces a shift to polymer-based sterile barrier systems. This limitation also excludes high-volume palletized sterilization common with EtO, fundamentally redefining packaging workflows and effective throughput. If your device portfolio or packaging line relies heavily on traditional materials, you must plan for a significant packaging requalification and workflow redesign project.

Q: When conducting a financial break-even analysis, what costs beyond equipment price should we include for in-house VHP?

A: Your analysis must include all capital expenditure for the chamber, generator, and facility build-out, plus projected operational costs for validation, skilled personnel, utilities, preventive maintenance, and consumables like hydrogen peroxide. Compare this total to the annualized cost of outsourcing, including per-load fees, validation services, and logistics. For a complete view, calculate the payback period and Net Present Value to frame the capital outlay as a strategic investment in control.

Related Contents:

- VHP vs Traditional Sterilization: 2025 Comparison

- VHP Sterilization in Healthcare: 2025 Best Practices

- Lab Sterilization with VHP: 2025 Expert Guide

- VHP Sterilization Process: 2025 Comprehensive Guide

- Top 10 Advantages of VHP Sterilization in 2025

- Validated VHP Sterilization SOPs | Audit Checklist for Regulatory Compliance

- VHP Sterilization Validation: 2025 Protocols

- VHP Sterilization Safety: Essential 2025 Guidelines

- GMP Compliant VHP Robots | FDA Validation Requirements