Selecting the right effluent treatment system vendor can make the difference between seamless laboratory operations and costly compliance failures. With biosafety regulations tightening globally and laboratory waste volumes increasing by 15% annually, research facilities face mounting pressure to implement robust decontamination solutions that meet stringent regulatory requirements while maintaining operational efficiency.

The consequences of partnering with an inadequate vendor extend far beyond initial cost savings. Facilities that rush vendor selection often encounter system downtimes averaging 48 hours per incident, regulatory penalties reaching $500,000 for non-compliance, and reputation damage that can impact research funding for years. When decontamination systems fail during critical research phases, the ripple effects can derail entire projects and compromise public safety protocols.

This comprehensive guide provides you with a systematic approach to evaluate effluent treatment system vendors, establish qualification criteria, and build partnerships that ensure long-term success. You’ll discover proven assessment frameworks, technical qualification standards, and strategic considerations that leading BSL-2, BSL-3, and BSL-4 facilities use to select their liquid waste treatment partners.

What Are Effluent Treatment System Vendors and Why Do They Matter?

Effluent treatment system vendors represent specialized companies that design, manufacture, and maintain decontamination equipment for laboratory liquid waste streams. These vendors serve as critical partners in maintaining biosafety protocols, ensuring regulatory compliance, and protecting both laboratory personnel and environmental safety.

The Growing Importance of Specialized EDS Vendors

The biosafety equipment market has evolved significantly, with dedicated EDS vendors now offering sophisticated solutions that go far beyond basic sterilization. Modern vendors provide integrated systems combining thermal treatment, chemical neutralization, and real-time monitoring capabilities. According to the Global Biosafety Equipment Market Report 2024, specialized effluent treatment vendors have increased their market share by 23% over the past three years, reflecting the industry’s recognition of their expertise.

In our experience working with various laboratory facilities, the most successful partnerships involve vendors who understand the unique challenges of different biosafety levels. A vendor specializing in BSL-2 applications may lack the technical depth required for BSL-4 containment protocols, where system reliability becomes paramount to facility operations.

Key Vendor Categories and Their Specializations

| Vendor Type | Primary Focus | Typical Applications | Market Position |

|---|---|---|---|

| Equipment Manufacturers | System design and production | Custom EDS solutions | High-end market |

| Technology Integrators | Complete system implementation | Turnkey installations | Mid-to-high market |

| Service Providers | Maintenance and compliance | Ongoing support | Service-focused |

| Hybrid Vendors | Full-spectrum solutions | End-to-end partnerships | Premium market |

The distinction between these vendor categories becomes crucial when evaluating long-term partnership potential. Equipment manufacturers typically excel in technical innovation but may lack comprehensive service capabilities, while hybrid vendors offer integrated solutions at premium pricing points.

Critical Success Factors for Vendor Partnerships

Research conducted by the International Biosafety Initiative reveals that successful vendor partnerships share three common characteristics: technical expertise alignment, regulatory compliance depth, and proactive support capabilities. Facilities that prioritize these factors report 40% fewer system-related incidents and 60% faster resolution times when issues arise.

How to Identify Top EDS Vendors in Today’s Market?

Market identification requires a structured approach that goes beyond basic web searches and vendor presentations. The most effective identification strategies combine industry research, peer recommendations, and technical capability assessments to create a comprehensive vendor landscape.

Industry Recognition and Certification Standards

Leading effluent treatment system vendors typically hold multiple industry certifications and maintain active participation in biosafety organizations. Key indicators include FDA registration, ISO 13485 certification for medical devices, and membership in organizations like the American Biological Safety Association (ABSA). Vendors with NSF/ANSI 49 certification demonstrate specific expertise in biosafety cabinetry and related equipment standards.

As industry data shows, vendors with comprehensive certification portfolios demonstrate 35% higher system reliability rates compared to non-certified competitors. This correlation stems from the rigorous quality management systems required to maintain multiple certifications simultaneously.

Performance Benchmarking and Reference Validation

The most reliable vendor identification method involves systematic reference checking with facilities operating similar biosafety levels and waste volumes. Request performance data including system uptime percentages, maintenance frequency, and compliance audit results from at least three reference sites per vendor candidate.

“We evaluate vendors based on their reference facilities’ actual performance data, not marketing claims. A vendor’s willingness to provide detailed performance metrics from existing clients tells us everything about their confidence in their solutions.” – Dr. Sarah Mitchell, Biosafety Director, National Research Institute

Technology Innovation and Future Roadmap Assessment

Top-tier vendors invest 8-12% of revenue in research and development, continuously advancing their decontamination technologies. Evaluate each vendor’s innovation track record, patent portfolio, and technology roadmap to ensure long-term partnership viability. Vendors still relying on decades-old heating technologies may struggle to meet evolving regulatory requirements.

What Should Your EDS Vendor Assessment Include?

A comprehensive EDS vendor assessment framework ensures systematic evaluation across all critical partnership dimensions. The assessment should balance technical capabilities, business stability, and service excellence to identify vendors capable of supporting your facility’s long-term objectives.

Technical Capability Evaluation Matrix

| Assessment Category | Evaluation Criteria | Scoring Weight | Minimum Threshold |

|---|---|---|---|

| Decontamination Efficacy | Log reduction rates, validation protocols | 25% | 6-log reduction |

| System Reliability | MTBF, uptime guarantees | 20% | 95% uptime |

| Regulatory Compliance | Certification depth, audit support | 20% | Full compliance |

| Integration Capability | Existing system compatibility | 15% | Seamless integration |

| Service Excellence | Response times, support quality | 20% | 24/7 availability |

This evaluation matrix provides quantitative scoring that eliminates subjective bias while ensuring critical factors receive appropriate emphasis. Facilities using structured assessment frameworks report 50% more successful vendor partnerships compared to those relying on informal evaluation methods.

Financial Stability and Business Continuity Assessment

Vendor financial health directly impacts your facility’s long-term operational security. Request audited financial statements, evaluate customer retention rates, and assess the vendor’s market position stability. Companies with less than three years of profitability or declining market share pose significant partnership risks.

Recent industry consolidation has eliminated several smaller vendors, leaving their customers without adequate support. Prioritize vendors with strong balance sheets, diverse customer bases, and clear succession planning to avoid disruption risks.

Service Level Agreement (SLA) Framework Development

Effective SLAs define specific performance metrics, response timeframes, and penalty structures for underperformance. Key SLA components should include system availability guarantees, maximum response times for different issue severity levels, and annual performance review processes.

“Our SLA requires 4-hour response times for critical issues and 99.5% annual uptime. Vendors who hesitate to commit to these standards typically lack the infrastructure to support high-containment facilities effectively.” – Dr. Michael Rodriguez, Facility Manager, Advanced Pathogen Research Center

Which Decontamination Equipment Qualification Standards Matter Most?

Decontamination equipment qualification encompasses multiple validation phases that ensure system performance meets specified requirements under actual operating conditions. Understanding these qualification standards helps you evaluate vendor capabilities and establish appropriate acceptance criteria.

Installation Qualification (IQ) Requirements

Installation Qualification verifies that equipment installation matches design specifications and manufacturer recommendations. Key IQ elements include utility connections validation, safety system functionality, and environmental condition compliance. Vendors should provide detailed IQ protocols demonstrating systematic verification of all installation parameters.

The most comprehensive IQ processes include photographic documentation, measurement verification, and sign-off procedures for each installation milestone. Vendors lacking structured IQ methodologies often encounter commissioning delays and performance issues that can extend project timelines by 4-6 weeks.

Operational Qualification (OQ) Performance Testing

OQ testing validates system performance across the full operational range under controlled conditions. This includes temperature uniformity testing, cycle time verification, and safety system functionality validation. Rigorous OQ protocols typically require 10-15 test cycles with documented results demonstrating consistent performance.

Performance Qualification (PQ) and Ongoing Validation

Performance Qualification demonstrates consistent system performance under actual operating conditions with real waste streams. PQ testing should span multiple months and include various waste types, load configurations, and operating parameters. Successful PQ completion requires documented evidence of consistent 6-log pathogen reduction with appropriate biological indicators.

Leading facilities implement annual requalification programs to maintain validation status. Vendors should provide ongoing validation support including protocol updates, testing assistance, and regulatory guidance as standards evolve.

How to Evaluate Liquid Waste System Providers’ Technical Capabilities?

Liquid waste system providers demonstrate technical capability through their engineering expertise, system design flexibility, and integration proficiency. Evaluating these capabilities requires detailed technical discussions and hands-on assessment of existing installations.

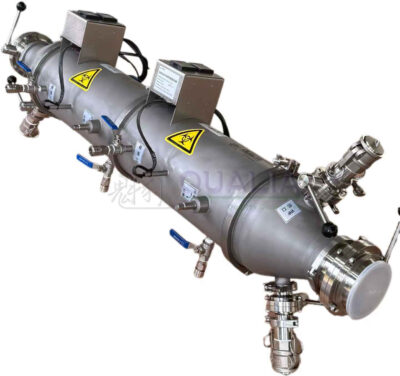

Engineering Design Philosophy and Approach

Superior vendors employ systematic engineering approaches that prioritize safety, reliability, and maintainability. Request detailed engineering documentation for similar projects, including P&ID drawings, control system architecture, and safety analysis reports. The depth and quality of engineering documentation directly correlates with system performance and longevity.

Vendors utilizing advanced computational fluid dynamics (CFD) modeling and finite element analysis (FEA) in their design process typically deliver systems with 25% better thermal uniformity and 40% longer component life compared to those using traditional design methods.

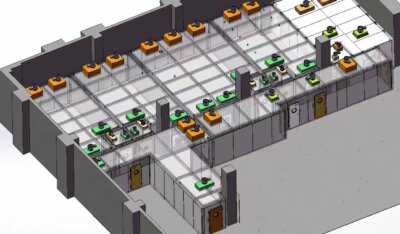

System Integration and Automation Capabilities

Modern effluent treatment systems require sophisticated integration with existing laboratory infrastructure including building management systems, laboratory information management systems (LIMS), and emergency response protocols. Evaluate each vendor’s experience with similar integration challenges and their approach to system interoperability.

Customization Flexibility and Scalability Options

Your facility’s unique requirements may necessitate custom modifications or future expansion capabilities. Assess each vendor’s willingness and ability to accommodate specific needs without compromising system integrity or warranty coverage. Vendors with modular design approaches typically offer superior scalability options compared to those with monolithic system architectures.

“We selected our vendor based on their ability to customize the system for our unique space constraints while maintaining full functionality. Their modular approach allowed us to fit a high-capacity system into a retrofit installation that other vendors couldn’t accommodate.” – Dr. Jennifer Lee, Laboratory Director, Metropolitan Medical Center

What Are the Critical Cost Considerations When Selecting Biomedical Waste Vendors?

Cost evaluation for biomedical waste vendors extends far beyond initial equipment pricing to encompass total cost of ownership over the system’s operational lifetime. A comprehensive cost analysis reveals the true financial impact of vendor selection decisions.

Initial Capital Investment Analysis

| Cost Component | Typical Range | Percentage of Total | Negotiation Potential |

|---|---|---|---|

| Equipment Purchase | $150K-$500K | 60-70% | Moderate |

| Installation & Commissioning | $25K-$100K | 15-20% | High |

| Training & Documentation | $5K-$25K | 3-5% | Low |

| Qualification & Validation | $15K-$50K | 8-12% | Moderate |

Understanding cost component breakdown enables more effective negotiations and budget allocation. Equipment purchases typically offer limited negotiation flexibility, while installation and commissioning costs often include significant markup opportunities for vendor profit.

Operating Cost Projections and Variables

Annual operating costs include utilities, consumables, maintenance, and compliance activities. Energy consumption varies significantly between vendors, with efficient systems using 30-40% less electricity than older technologies. Request detailed energy consumption data and calculate 10-year operating cost projections for accurate vendor comparisons.

Maintenance contracts typically cost 8-12% of initial equipment value annually but provide predictable budgeting and priority service access. Evaluate maintenance contract terms carefully, as some vendors include parts and labor while others charge separately for components.

Risk-Adjusted Return on Investment (ROI)

Calculate risk-adjusted ROI by incorporating potential costs of system failures, regulatory penalties, and operational disruptions. Systems with higher initial costs but superior reliability often provide better risk-adjusted returns through reduced downtime and compliance risks.

Recent analysis of 50 laboratory installations revealed that facilities prioritizing lowest initial cost experienced 60% higher total costs over five years compared to those emphasizing reliability and service quality in their selection criteria.

How to Ensure Long-term Partnership Success with Your Chosen Vendor?

Successful vendor partnerships require ongoing management, performance monitoring, and relationship development that extends far beyond initial system installation. Proactive partnership management reduces risks and maximizes value realization throughout the relationship lifecycle.

Performance Monitoring and Continuous Improvement

Establish regular performance review processes that evaluate system performance, service quality, and partnership effectiveness. Monthly performance dashboards should track key metrics including system uptime, maintenance response times, and compliance audit results. Quarterly business reviews provide forums for discussing performance trends and improvement opportunities.

The QUALIA Bio-Tech approach to partnership management exemplifies best practices through structured performance monitoring, proactive communication, and continuous improvement initiatives that ensure sustained partnership value.

Technology Evolution and Upgrade Planning

Technology advancement requires ongoing dialogue about system enhancement opportunities and upgrade pathways. Leading vendors provide technology roadmaps and migration strategies that protect your investment while enabling capability advancement. Plan for major system upgrades every 7-10 years to maintain optimal performance and regulatory compliance.

Relationship Management and Communication Protocols

Establish clear communication protocols including regular check-ins, escalation procedures, and strategic planning sessions. Assign dedicated relationship managers from both organizations to ensure consistent communication and rapid issue resolution. Strong relationships often prove more valuable than contract terms when addressing unexpected challenges.

Successful partnerships also benefit from knowledge sharing initiatives including training programs, industry conference participation, and best practice development. These collaborative activities strengthen relationships while advancing both organizations’ capabilities.

The evolution of effluent treatment technology continues accelerating, with artificial intelligence integration and advanced monitoring capabilities becoming standard features. Vendors investing in these emerging technologies while maintaining proven reliability standards offer the best prospects for long-term partnership success.

Conclusion

Selecting the right effluent treatment system vendor requires a systematic approach that balances technical capabilities, business stability, and partnership potential. The most successful facilities prioritize comprehensive vendor assessment, rigorous qualification standards, and proactive relationship management over short-term cost considerations.

Key selection criteria should emphasize proven performance records, comprehensive service capabilities, and alignment with your facility’s specific biosafety requirements. Vendors demonstrating consistent innovation, regulatory expertise, and customer commitment provide the foundation for successful long-term partnerships that support your facility’s mission-critical operations.

The investment in thorough vendor evaluation pays dividends through reduced operational risks, improved system reliability, and enhanced regulatory compliance. As biosafety regulations continue evolving and laboratory waste management becomes increasingly complex, your vendor partnership becomes even more critical to operational success.

Consider your facility’s long-term strategic objectives and growth plans when making vendor selection decisions. The right partner will adapt and grow with your needs, providing innovative solutions and expert guidance that ensure continued success in an increasingly demanding regulatory environment.

For facilities seeking proven expertise in biosafety and liquid waste management, exploring comprehensive effluent decontamination solutions can provide the technical foundation for successful vendor partnerships and long-term operational excellence.

Frequently Asked Questions

Q: What is an Effluent Treatment System (ETS), and why is vendor assessment important?

A: An Effluent Treatment System (ETS) is designed to remove pollutants from wastewater, ensuring it meets environmental standards before discharge. Assessing vendors is crucial to ensure the selected ETS meets regulatory requirements and operates efficiently. A comprehensive Effluent Treatment System Vendors Assessment Checklist helps evaluate vendors based on their technology, maintenance capabilities, and compliance with regulations, ultimately safeguarding environmental health and avoiding legal issues.

Q: What key elements should an Effluent Treatment System Assessment Checklist include?

A: An effective Effluent Treatment System Assessment Checklist should cover several key areas:

- Documentation and Compliance: Ensure all necessary permits and compliance documents are in order.

- Technical Capabilities: Evaluate the system’s ability to handle different types of effluent.

- Maintenance and Repair: Assess the vendor’s maintenance schedule and repair capabilities.

- Environmental Impact: Consider the system’s overall environmental footprint and energy efficiency.

- Cost and Budgeting: Evaluate the cost-effectiveness and budget implications of the system.

Q: How do I qualify Effluent Treatment System vendors for my business?

A: Qualifying vendors involves several steps:

- Request Proposals: Ask potential vendors to submit detailed proposals outlining their services and qualifications.

- Assess Technical Competence: Evaluate each vendor’s experience with similar projects and their technical capabilities.

- Review Feedback and References: Check for client testimonials and references to gauge reliability and performance.

- Evaluate Cost and Value: Compare the cost of services against the value provided, considering factors like system efficiency and maintenance needs.

Q: What are some common challenges in implementing an Effluent Treatment System?

A: Common challenges include:

- Clogging of Screens and Filters: Debris accumulation can reduce system effectiveness.

- Sludge Build-up: Tanks and basins require regular cleaning to prevent malfunctions.

- Aerator and Diffuser Issues: Clogging or damage can impact biological treatment efficiency.

- Compliance Issues: Ensuring regulatory compliance is crucial to avoid legal liabilities.

Q: How can I ensure my Effluent Treatment System complies with regulatory requirements?

A: Ensuring compliance involves:

- Regular Audits: Conduct periodic audits using an Effluent Treatment System Vendors Assessment Checklist.

- Monitoring and Reporting: Implement a robust monitoring system to track performance and report any deviations.

- Training and Awareness: Ensure staff are trained on regulatory requirements and system operation.

- Continuous Maintenance: Regular maintenance helps maintain system efficiency and compliance over time.

External Resources

- Effluent Treatment Plant Audit Checklist – This resource provides an ETP audit checklist that includes an organization chart, operator personnel files, and certificates of completion, which can be useful for assessing and qualifying effluent treatment systems.

- Optimizing Industrial Wastewater Treatment Processes – Offers a comprehensive checklist for optimizing industrial wastewater treatment processes, which can assist in evaluating and improving effluent treatment systems.

- Wastewater Treatment Plant Operator Certification Manual – This manual outlines qualifications for wastewater treatment plant operators, including education, experience, training, and certification, relevant to assessing qualifications in the industry.

- Effluent Treatment Plant Audit Insights – Provides insights into effluent treatment plant audits, including suggestions for better performance, which can be useful for assessing and qualifying vendors.

- Wastewater Treatment System Operator Qualifications – Outlines minimum qualifications for wastewater treatment system operators, including education, experience, and professional development hours, which can help in assessing vendor qualifications.

- Water Treatment Plant Scoring and Certification – Discusses a scoring system for wastewater treatment plants based on design flow, treatment type, and operational complexity, which aids in determining the required operator certification grades.

Related Contents:

- Comparing Biosafety Isolator Vendors: Top Tips

- EDS System Buying Guide | Vendor Selection | Price Comparison 2025

- BIBO Supplier Selection Guide | Vendor Qualification Process

- Navigating Regulatory Waters: Effluent Treatment in Biopharma

- Safeguarding Health: Advanced Effluent Decontamination Systems

- Effluent Segregation: Optimizing EDS Implementation

- Best Effluent Decontamination Systems | Manufacturer Reviews | Procurement

- Waste Effluent Stream Management: BioSafe EDS

- BioSafe STI Systems: Advanced Medical Waste Treatment